The latest ranking of the world’s top ten wafer foundries (TOP 10)!

According to research by TrendForce, although the demand for consumer electronics continues to be weak, the structural growth needs of industries such as servers, high-performance computing, automotive and industrial control remain unabated, which has become a key driver to support the growth of wafer foundry in the medium and long term.

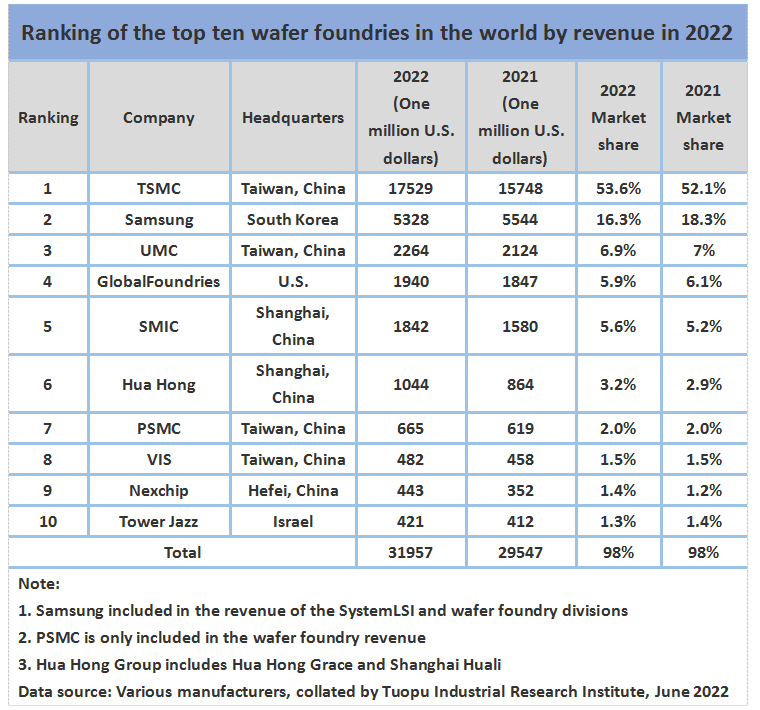

At the same time, due to the production of a large number of wafers with price increases in the first quarter of 2022, the output value of the quarter hit a new high for 11 consecutive quarters, reaching US$31.96 billion, a quarterly increase of 8.2%, slightly less than the previous quarter. In terms of ranking, the biggest change is that Hefei Nexchip surpassed Tower Semiconductor to ninth.

Samsung was hit by the terminal demand freeze, the only revenue of the top ten players fell

Due to TSMC’s overall increase in wafer prices in the fourth quarter of last year, this batch of wafers will be mainly produced in the first quarter of 2022, coupled with the continued strong demand for high-performance computing and better foreign currency exchange rates.

This made TSMC’s revenue in the quarter reached 17.53 billion US dollars, a quarterly increase of 11.3%.The quarterly revenue growth of each process node is generally about 10%, and the 7/6nm and 16/12nm processes have the highest growth rate due to small production expansion.Only the 5/4nm process revenue declined due to the impact of Apple’s iPhone 13 entering the off-season of production and stocking.

Due to the sluggish market conditions such as TVs and smartphones, the demand for System LSI CIS and driver ICs has weakened. Samsung, which ranked second, became the only foundry with negative revenue growth this quarter, with revenue reaching 5.33 billion, a quarter-on-quarter decrease of 3.9%, and its market share also fell to 16.3%.

UMC also benefited from the price increase of wafers, and its revenue hit US$2.26 billion, a quarterly increase of 6.6%, ranking third.However, UMC’s new production capacity has not yet been opened this year, so the proportion of revenue from each process is roughly the same as that in the fourth quarter of last year.

GlobalFoundries reported revenue of $1.94 billion for the quarter, up 5.0% quarter-on-quarter.Since wafer shipments were roughly the same as the previous quarter, the growth was mainly due to the adjustment of average unit price and the optimization of product mix, ranking fourth.

In addition, as one of the major wafer foundries in the United States, GF has assisted in the production of “Made in America” national security and aerospace-related chips for many years. Recently, it plans to produce 45nm SOI process products to support the operation of defense and aviation systems. The first production chips are expected to be delivered in 2023.

Semiconductor Manufacturing International Corporation (SMIC) has benefited from the recent increase in wafer shipments due to the smooth production of production capacity. At the same time, the product portfolio has gradually shifted to structurally in short supply products, such as consumer PMICs, AMOLED DDIs, industrial control, automotive PMICs, MCUs, etc.

Driven by the continuous growth of revenue, the revenue in the first quarter reached 1.84 billion US dollars, a quarterly increase of 16.6%, ranking fifth.

Jinghe Integrated Manufacturing Co., Ltd. actively expands production and squeezes out high tower semiconductors, and the three major players in mainland China account for more than 10% of the market.

The sixth to eighth places are HuaHong Group, PSMC, World Advanced (VIS), Benefited from the continuous full capacity utilization rate, the opening of new capacity, the average selling price and the adjustment of product mix, the revenue performance all increased.

Hefei Jinghe Integrated’s first-quarter revenue reached US$440 million, a quarterly increase of 26.0%, the highest growth rate among the top ten companies. At the same time, it also surpassed Tower Semiconductor (Tower) and jumped to the ninth place, narrowing the market share gap with the eighth world advanced.

According to TrendForce, Hefei Jinghe Integrated Circuit is currently mainly producing 0.1Xμm and 90nm large-size driver ICs, and will continue the keynote of active production expansion in 2022, aiming to complete the construction of the N2 factory area.

At the same time, in order to reduce the possible risks of a single market downturn, the pace of developing multiple product platforms such as TDDI, CIS, MCU and PMIC has also been accelerated.

At present, Hefei Jinghe Integration has cooperated with SmartSens to successfully develop 90nm CIS products, which will contribute to non-driver IC revenue after mass production.

The 10th highest tower is due to the relative shortage of industrial control and automotive analog-related chips. Its revenue in the first quarter increased to US$420 million, a 2.2% quarterly increase.

In order to continue its technological advantages in the field of PMIC, it has also actively explored the application of PMIC technology recently, developed higher voltage tolerance and effectively reduced the chip area to supply high-performance computing such as CPU and GPU, as well as automotive and industrial control power management needs.

Looking ahead to the foundry market in the second quarter, TrendForce expects that with the increase in the capacity of a small number of foundries to drive the overall shipment growth, the output value of the top ten foundries will maintain a growth trend in the second quarter.

However, considering the continued sluggish demand for consumer end products, the contribution of wafers with higher prices has been roughly reflected in the first quarter, and the quarterly growth rate will converge again.