12-inch semiconductor wafers are in short supply

The history of semiconductor silicon wafer development: it started in the United States, and Japan came later

Semiconductor silicon wafers started in the United States, and MEMC has led the development of technology and set a number of global firsts. The semiconductor industry originated in the United States, and the same is true for semiconductor silicon wafers.

In 1956, Monsanto Chemical Company established Monsanto Electronic Materials (MEMC Electronic Materials, MEMC), responsible for the production of silicon wafers for transistors and rectifiers. In the following decades, MEMC has made great contributions to the development of industry technology and industry standards.

The breakthrough technologies include chemical mechanical polishing (CMP), growth of epitaxial layers, zero-dislocation crystals, oxygen control, etc.; The world’s first mass-produced 4-inch and 8-inch silicon wafer manufacturer.

As an industry leader, MEMC gained an 80% market share in the 1960s. However, due to continuous losses in the later period, Monsanto sold MEMC to a German chemical company in 1989, and was acquired by Global Wafer of Taiwan, China in 2016.

With the rise of local semiconductors, Japanese silicon wafer manufacturers have come from behind, and Korean and Taiwanese companies have also gained a place in the world. In the late 1950s, Japanese companies began to deploy the silicon wafer industry through technology introduction.

Driven by the Very Large Scale Integrated Circuit Research Program (VLSI, 1976-1980), the Japanese semiconductor industry developed rapidly. Among them, memory surpassed the United States in the 1980s, and silicon wafer manufacturers also achieved a golden period of development during this period.

Finally, through mergers and acquisitions Two international semiconductor silicon wafer giants, Shin-Etsu Chemical and SUMCO, were formed. In 2001, Shin-Etsu Chemical took the lead in mass-producing 12-inch semiconductor silicon wafers in the world.

After surpassing the United States in the 1990s, the Japanese semiconductor wafer industry still dominates the world. In the 1990s, the semiconductor industry shifted from Japan to South Korea and Taiwan, China, and South Korea and China Taiwan’s silicon wafer companies were able to grow and gain a global presence.

Competitive landscape: Strong supply demand in mainland China, market concentration is expected to decline

The development of the semiconductor wafer industry is accompanied by mergers and acquisitions, and the competitive landscape has shifted from fragmentation to concentration. The development of the semiconductor wafer industry was dominated by the US MEMC in the early stage, and then many companies participated in the competition.

In 1998, the market pattern was extremely fragmented, and there were more than 25 major market players in the world. However, as the size of silicon wafers becomes larger and larger, the required investment is greatly increased, and the scale effect is the key to corporate profitability.

In the case of continuous losses of many silicon wafer manufacturers, mergers and acquisitions continue to occur. Through continuous integration and acquisitions, the global semiconductor wafer industry has shifted from fragmentation to concentration. In 2019, the world’s top five silicon wafer manufacturers have a combined market share of more than 90%.

In the context of tense international relations, the security of the semiconductor supply chain has become the focus of governments and enterprises in various countries. Semiconductor silicon wafers are the core raw materials.

Under the influence of supply represented by semiconductor wafer manufacturers in mainland China, the competitive landscape of the semiconductor wafer industry Changes are expected, and global market concentration is expected to decrease.

According to SEMI data, the combined market share of the world’s top three semiconductor silicon wafer manufacturers in 2020 will drop from 68.2% in 2019 to 63.8%; the combined market share of the top five manufacturers will drop from 92.6% to 86.6%.

Demand for 8-inch and 12-inch silicon wafers increases, and demand for small-sized silicon wafers is stable

The increase in semiconductor content promotes the increase in the area of silicon wafer shipments, and the global silicon wafer shipment area in 2021 will reach a record high. Historically, the average annual growth rate of the semiconductor industry has been higher than the overall market for electronic systems.

The main driving force is the increasing content of semiconductors used in electronic systems. For example, as the growth of global mobile phone, automobile and PC shipments matures and slows down, the electronic systems market will grow at a CAGR of 3.5% from 2011 to 2021, while the semiconductor industry will grow at a CAGR of 2011-2021.

The rate is 6.5%. According to IC Insights, the semiconductor content in electronic systems increased to 33.2% in 2021, a record high, while the final value is expected to exceed 40%. Driven by semiconductor content, the area of silicon wafer shipments has been on the rise.

According to SEMI data, the global silicon wafer shipment area in 2021 will reach 14.165 billion square inches, a record high.

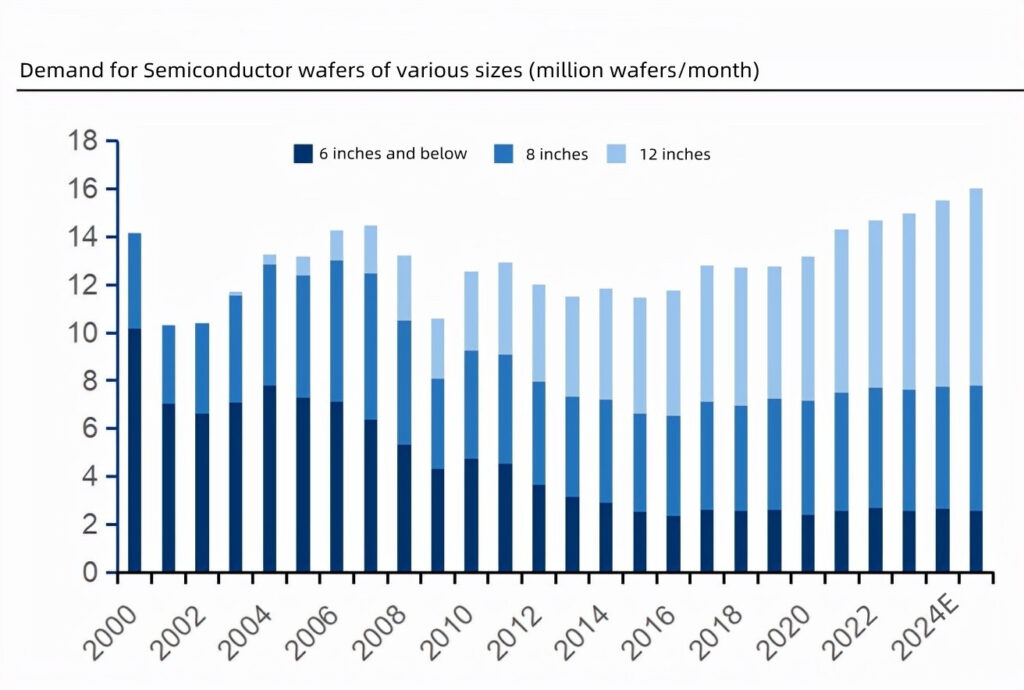

The new demand for semiconductor silicon wafers is concentrated in 8 inches and 12 inches, and the demand for silicon wafers of 6 inches and below is stable.

According to Omdia data, the demand for semiconductor wafers of 6 inches and below showed a downward trend between 2000 and 2015, and remained basically stable after 2015; after commercial production of 12-inch silicon wafers in 2001, the demand continued Climb; 8-inch silicon wafer demand fluctuates relatively little.

Omdia expects that from 2021 to 2025, the demand for 8-inch and 12-inch semiconductor wafers will increase, and the demand for 6-inch and smaller wafers will remain stable.

In terms of the number of shipments, in 2021, 12 inches will account for 47.7%, 8 inches will account for 34.3%, and small sizes will account for 18.0%. Compared with 22.6%, the small size accounts for 6.5%.

Based on cost considerations, discrete devices continue to use small sizes, and integrated circuits migrate to large sizes.

Due to the low price of discrete devices, manufacturers are not motivated to invest in large-scale production lines.

At present, silicon wafers of 6 inches and below are still the main products. The economic benefits brought by the use of large-size silicon wafers in integrated circuits are obvious.

For example, the area of a 12-inch silicon wafer is 2.25 times that of an 8-inch wafer, and the usable rate is about 2.5 times that of an 8-inch wafer. The cost of the chip is then reduced.

If the cost savings brought by the increase in silicon wafer size can compensate for the cost of investing in large-scale wafer manufacturing lines, manufacturers will have the motivation to migrate to large-scale wafers.

The size of the largest semiconductor silicon wafer currently commercially available is 12 inches, and the 18-inch (450mm) silicon wafer has not yet seen the possibility of mass production due to the difficulty of the process and technology.

12-inch semiconductor silicon wafers are in strong demand, and the supply and demand situation is expected to continue until 2026

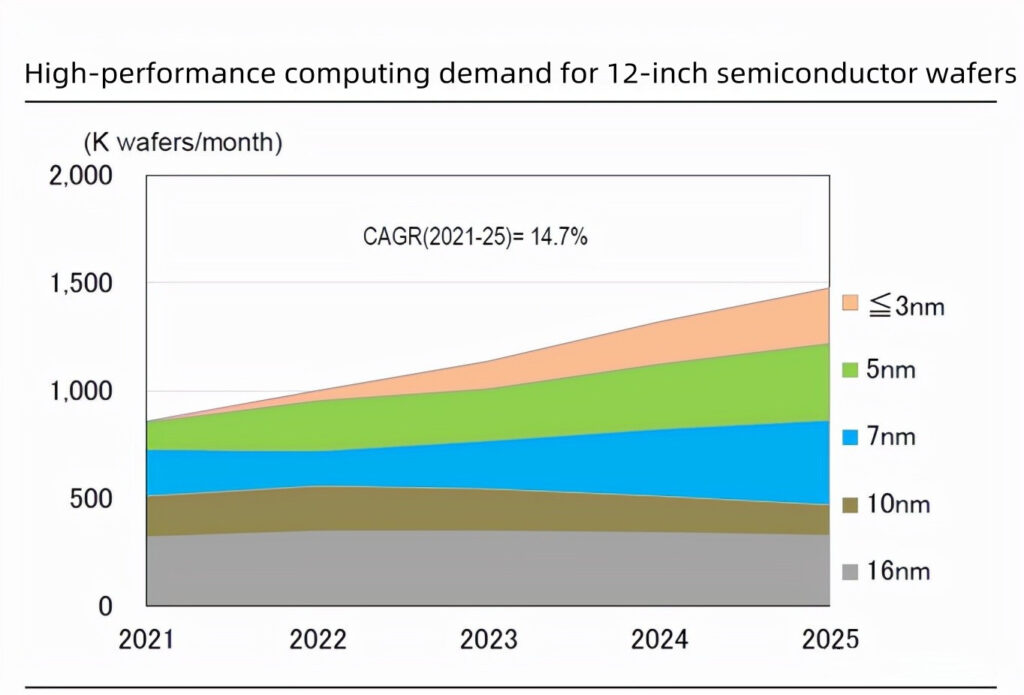

New demands such as telecommuting, automotive semiconductors, and Metaverse are driving the demand for 12-inch semiconductor wafers. According to SUMCO’s forecast in February 2022, the demand for 12-inch semiconductor silicon wafers will increase driven by new demands such as telecommuting, online meetings, autonomous driving, and the Metaverse, of which the global data volume will increase from 13ZB to 160ZB per year , the demand for data computing and storage is strong.

SUMCO expects a CAGR of 14.7% and 10% for high-performance computing and DRAM demand for 12-inch semiconductor wafers, respectively, in 2021-2025.

Downstream fabs are actively investing in expansion, increasing demand for 12-inch semiconductor wafers. In order to meet the needs of downstream terminals, fabs are increasing capital expenditure to expand production capacity.

It is estimated that the total investment in 2022 will be about 150 billion US dollars. Among them, third-party foundries are particularly active in advanced processes, with a CAGR of 8.1% from 2020 to 2025. IDM The CAGR of 4.6%.

Under the high capital expenditure, the global demand for 12-inch polished wafers is expected to increase from 3.751 million wafers/month in 2020 to 5.554 million wafers/month in 2025, and epitaxial wafers will increase from 2.292 million wafers/month to 2.682 million wafers/month month; the volume of 12-inch silicon wafers required by wafer foundries will increase from 1.593 million pieces/month in 2020 to 2.748 million pieces/month in 2025.

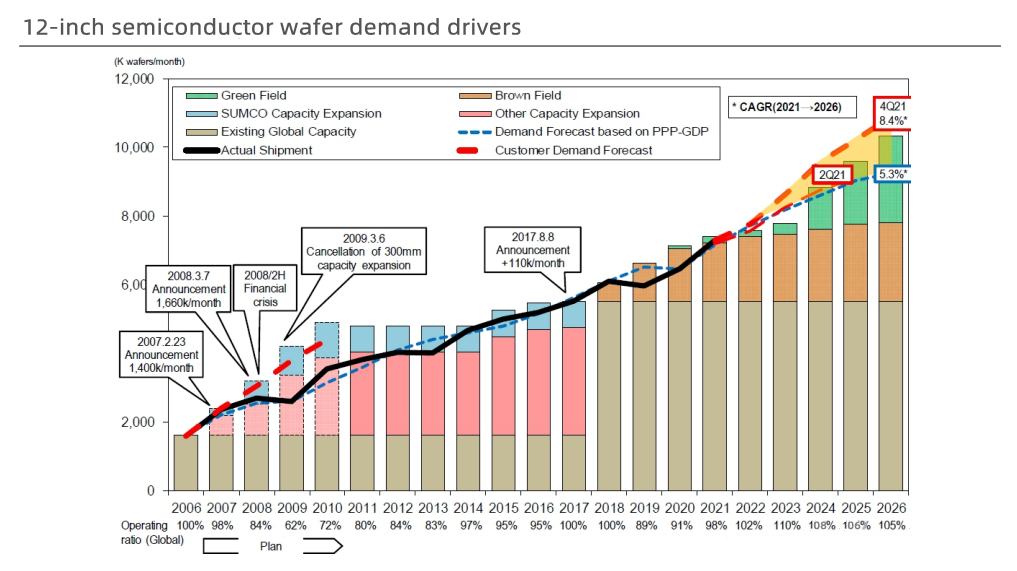

The expansion of production has lagged behind the increase in demand, and the supply of 12-inch semiconductor silicon wafers is in short supply.

According to SUMCO’s latest forecast in February, the CAGR of 12-inch wafer demand in 2021-2026 is 8.4%.

Since the large-scale production of the new plant for 12-inch semiconductor silicon wafers needs to wait until 2024, and the progress of production expansion lags behind the increase in demand, the supply gap of 12-inch silicon wafers in 2022 and 2023 will be larger than that in 2021.

It is expected that from 2022 to 2026, the global The capacity utilization rate of 12-inch silicon wafer manufacturers will remain above 100%.

In addition, the shortage of silicon wafers of 8 inches and below will also continue in 2022. Based on this, after entering 2022, major semiconductor silicon wafer manufacturers will raise prices again on the basis of price increases in 2021.

SUMCO expanded its production in a large amount to meet the long-term demand, and also announced production expansion after the global wafer acquisition failed.

SUMCO has signed a 5-year long-term contract with customers from 2022 to 2026. In order to meet customer needs, SUMCO plans to invest 228.7 billion yen (about 12.5 billion yuan) to expand production in new plants in Imari and Omura, which is the first time since 2008. Invest in building new factories.

The two new plants will start construction in 2022, start production in the second half of 2023, and reach full production by the end of 2025 and 2023, respectively. These new production capacities are included in the long-term contract. After Global Wafer’s acquisition of Siltron Electronics failed, it also announced a production expansion plan in February 2022.

It will invest NT$100 billion (about 22.8 billion yuan) from 2022 to 2024 to expand existing factories and build new ones. The new production line is expected to start production in the second half of 2023.

https://www.youtube.com/watch?v=N57A-9mi-Mk

Contact us to know more !

and here are more interesting applications .